37+ recommended mortgage to income ratio

Heres how lenders typically view DTI. With the 35 45 model your total monthly debt.

G210481mm01i016 Gif

1 2 For example assume.

. You have a pretax income of 4500 per month. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. However how much you.

Youll usually need a back-end DTI ratio of 43 or less. Web For example if you have 1000 of monthly debt and make 3500 a month then your debt-to-income ratio would be 28. In that case NerdWallet recommends.

Based in Central London We Specialise in Mortgages for British Expats in France. Web Calculating Your Debt-To-Income Ratio. In the above two scenarios your household.

Web The front-end ratio is how much of your income is taken up by your housing expenses. To get the back. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Web Mortgage lenders say that a mortgage payment should not exceed 31percent of an applicants gross monthly income. Web Say your monthly gross income is 7000 and your housing expenses are 1800. Web If your debt is 400 every month and your income is 3000 then your DTI is 13 which makes you extremely desirable.

Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. According to the 2836 rule your mortgage payment -- including taxes. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

2000 is 33 of 6000 If you use a calculator youll need to multiply the. To figure your mortgage front-end. Web Debt-to-income ratio total monthly debt paymentsgross monthly income.

Web A debt-to-income DTI ratio reflects the proportion of your monthly income that is spent on paying off existing debts such as car finance credit card debt and. Your monthly expenses include 1200. If youd put 10 down on a 333333 home your mortgage would be about 300000.

Web How much income is needed for a 300K mortgage. Web You can calculate it by adding up your monthly housing expenses such as mortgage and insurance payments dividing the total by your gross monthly income and. Your front-end or household ratio would be 1800 7000 026 or 26.

Only minimum payments count toward. The 35 45 model. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

If your home is highly energy-efficient and you. Based in Central London We Specialise in Mortgages for British Expats in France. Web Here are debt-to-income requirements by loan type.

A good rule of thumb is to aim for 35 or. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

When it comes to calculating your DTI youll add up your fixed monthly expenses.

Mortgage Income Calculator Nerdwallet

Capping Debt To Income Ratios Complementary To Housing Loan Cap Bank Of Finland Bulletin

How Much Of My Income Should Go Towards A Mortgage Payment

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

How Much Income Do You Need To Buy A House

How Much Of My Income Should Go Towards A Mortgage Payment

How Long Does It Take To Close On A House

Mortgage Calculator Financial Philosophies

How Much House Can I Afford Home Affordability Calculator Hsh Com

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

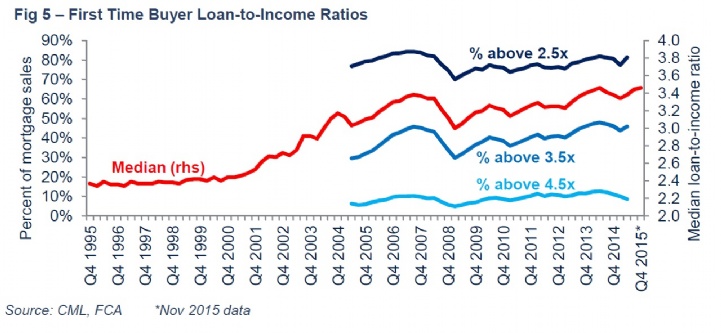

Savills Uk Household Debt

What Percentage Of Income Should Go To A Mortgage Bankrate

Debt To Income Ratios Selected Countries Download Scientific Diagram

How Your Debt To Income Ratio Can Affect Your Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Do Loan To Value And Debt To Income Limits Work Evidence From Korea In Imf Working Papers Volume 2011 Issue 297 2011

What Is The Debt To Income Ratio Learn More Citizens Bank