How much do banks lend for mortgages

Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan. Banks and building societies will usually lend a maximum of four-and-a-half times the total annual income of you and anyone else youre buying with.

Bank Statements For Mortgage Applications Niche Mortgage Broker

Mortgage rates hit a new 14-year high of 602 the week ending Sept15 as the Federal Reserve is expected to raise its rate next week.

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

. Get refinanced with an FHA loan. A 95 loan at 660k could result in LMI of about 30k. As an example For a 475K property loan at 95 LVR inclusive of LMI the LMI could be around 15k.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Its A Match Made In Heaven. The rate on the 30-year fixed mortgage hit 602 this week according to Freddie Mac.

Ad Find Mortgage Lenders Suitable for Your Budget. But ultimately its down to the individual lender to decide. Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

For a reverse mortgage they could run as much as 15000. Save Time Money. Loan agent compensation varies widely.

The interest rate on federal student loans taken out for the 2022-2023 academic year already rose to 499 up from 373 last year and 275 in 2020-2021. Most places have a per-loan cap on commission. Most lenders ideally like to see a down payment of around 20 of the price of the home.

Trusted VA Loan Lender of 300000 Veterans Nationwide. For this reason our calculator uses your. For example banks will lend at an average between 10 to 30.

Some receive a flat salary but most are paid on commission. I could close a 5 million dollar loan and make 7500 dollars for example. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a. Mortgages are already paid by the mortgage lender when the loan is taken out.

Bankrate LLC NMLS ID 1427381 NMLS Consumer Access BR Tech Services Inc. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Ad Compare the Best Mortgage Lender To Finance You New Home.

Theyre generally not going to lend more than the house. Americans are rich by world standards. Putting 20 down on your home eliminates the need for private mortgage insurance PMI.

A basis point is equivalent to 001 The most frequently. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Choose Smart Apply Easily.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Special Offers Just a Click Away. As part of an.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on. Heres where interest rates are headed. For example if your total household income.

Looking For A Mortgage. Find out how much you could borrow. The average 30-year fixed mortgage interest rate is 619 which is an increase of 11 basis points from one week ago.

Receive Your Rates Fees And Monthly Payments. Trusted VA Loan Lender of 300000 Veterans Nationwide. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as.

The poll results below from Inside Mortgage Finance. They can also earn early commission and tracking where they receive some monthly payments during the. The FHA has low rates and lenient credit qualifications.

Ad Compare Mortgage Options Get Quotes. Use Our Comparison Site Find Out Which Mortgage Lender Suits You The Best. How much home loan can bank give.

Were Americas 1 Online Lender. There is a big difference in pay based on whether youre fulfilling a. The interest is 6 which incorporates the lender borrowing the funds at 4 interest and extending a mortgage at 6 interest meaning the lender earns 2 in interest on the loan.

Get Started Now With Quicken Loans. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house. LMI is always capitalised into a.

DTI Often Determines How Much a Lender Will Lend. NMLS ID 1743443 NMLS. The French like this because it means the financial system and property market.

Compare Quotes See What You Could Save. Ad The FHA Loan cash out refinance is more available now than ever before. Medium Credit the lesser of.

Get Offers From Top Lenders Now. Banks are allowed to lend out 90 of your deposit and can not touch 10 of it. Banks are allowed to lend out 90 of your deposit and can not touch 10 of it.

What Is A Mortgage

Mortgage Interest Rates 2022 Moneysupermarket

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Lenders Tighten Mortgage Lending Rules Which News

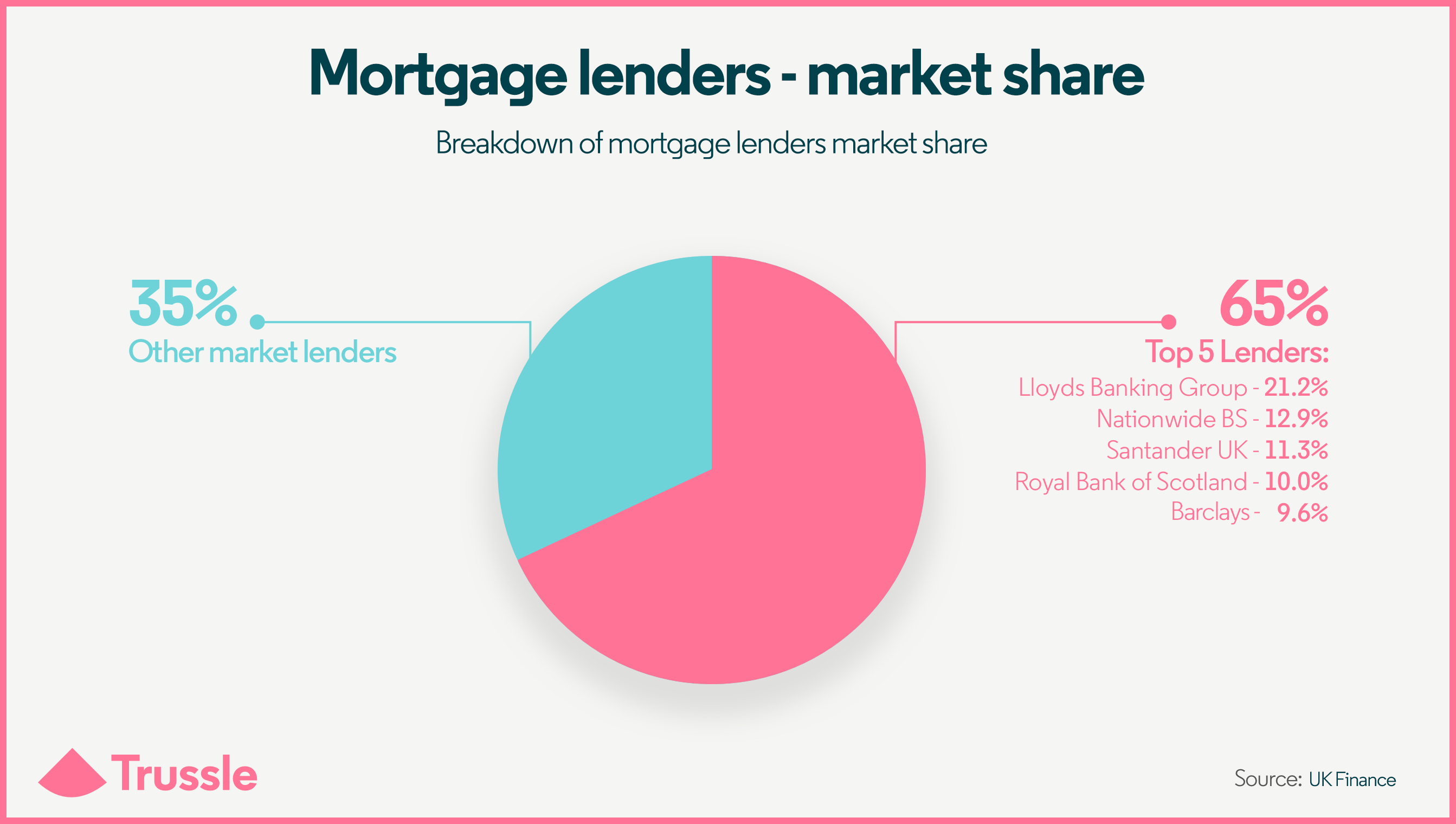

Mortgage Lenders Reviews Of The Best Mortgage Lenders Trussle

How To Get Your Mortgage Pre Approval In Uae Preapproved Mortgage Mortgage Mortgage Approval

How Do Mortgages Work Mortgage Guide Natwest

Compare Mortgages Get Our Best Rates Forbes Advisor Uk

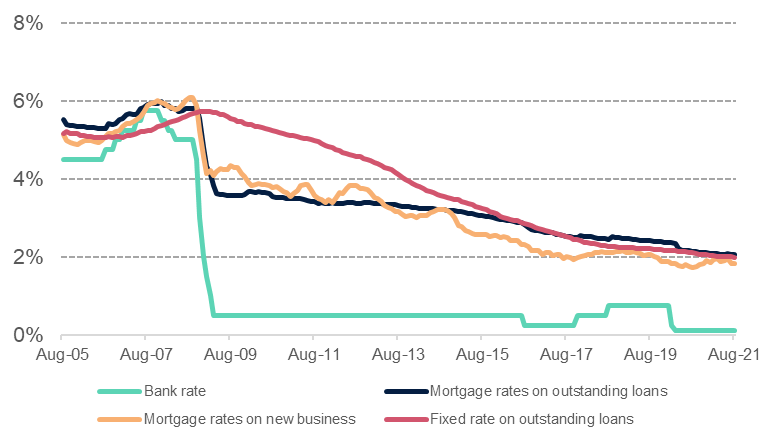

How The Bank Rate Affects Mortgage Rates Insights Uk Finance

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Qdxozqvdmky7ym

The Complete List Of Hmo Mortgage Lenders Thehmomortgagebroker

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage Loans

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

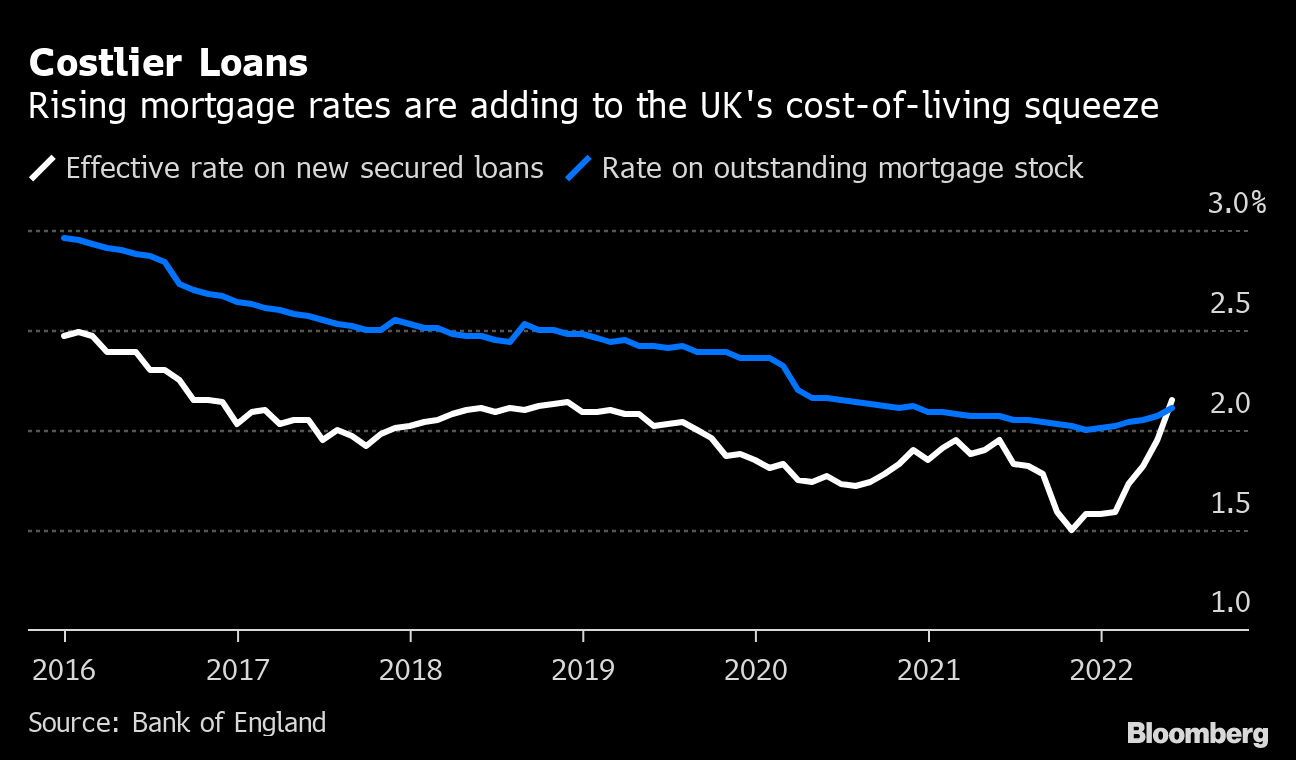

Uk Mortgage Lending Slows As Higher Interest Rates Squeeze Cost Of Living Bloomberg

What You Should Know When Shopping For A Mortgage Home Buying Mortgage Real Estate Advice